Shares of Super Micro Computer Inc. (NASDAQ: SMCI) dropped approximately 6% in New York trading on Tuesday following the release of a critical report by short-seller Hindenburg Research. The report raised significant concerns about the company’s accounting practices and corporate governance, potentially alarming investors and shareholders.

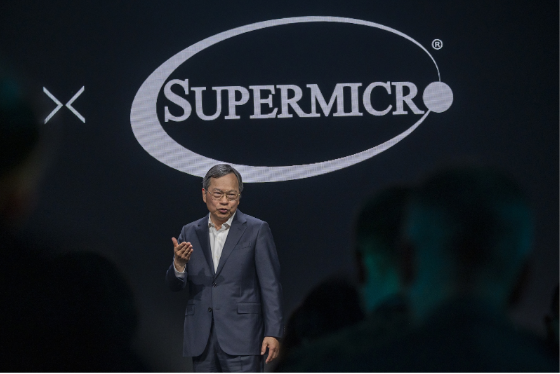

Super Micro, a $35 billion server manufacturer, has been under scrutiny since its 2018 delisting from Nasdaq for failing to file financial statements. Despite settling with the SEC for $17.5 million in August 2020 over accounting violations, Hindenburg Research claims the company resumed problematic practices shortly thereafter.

The report accuses Super Micro of improper revenue recognition and the rehiring of executives previously involved in accounting scandals. “Less than three months after paying a $17.5 million SEC settlement, Super Micro began rehiring top executives directly involved in the accounting scandal,” the report states, citing litigation records and interviews with former employees.

Hindenburg Research also questions Super Micro’s relationships with related parties, noting that CEO Charles Liang’s brothers control suppliers Ablecom and Compuware, which received $983 million from Super Micro over the past three years. These transactions, described as circular and not fully disclosed, are said to pose risks to revenue recognition and reported margins.

Additionally, the report raises concerns about Super Micro’s dealings with sanctioned countries. Despite a 2006 guilty plea for exporting banned components to Iran and assurances of compliance with U.S. export bans to Russia, the report suggests that exports to Russia may have increased, potentially breaching sanctions.

The report also highlights competition and quality issues contributing to the loss of key customers. Major companies such as Nvidia (NASDAQ: NVDA), CoreWeave, and Tesla (NASDAQ: TSLA) have reportedly reduced their reliance on Super Micro in favor of competitors like Dell (NYSE: DELL). The company’s customer service and product reliability issues have further damaged its reputation, with reports of high malfunction rates and service problems.