Nvidia has once again delivered quarterly results that have surpassed Wall Street’s expectations, driven by the surging demand for its semiconductors, which are essential for powering artificial intelligence (AI) applications.

On Wednesday, the company reported that its revenue more than doubled in the latest quarter compared to the same period last year. Nvidia also anticipates further revenue growth in the current quarter, which ends in October. Investors are closely monitoring whether the demand for Nvidia’s products can sustain its current momentum.

Nvidia’s rapid ascent to becoming a leading player in the AI industry has yielded some impressive financial figures. Here’s a closer look at the numbers:

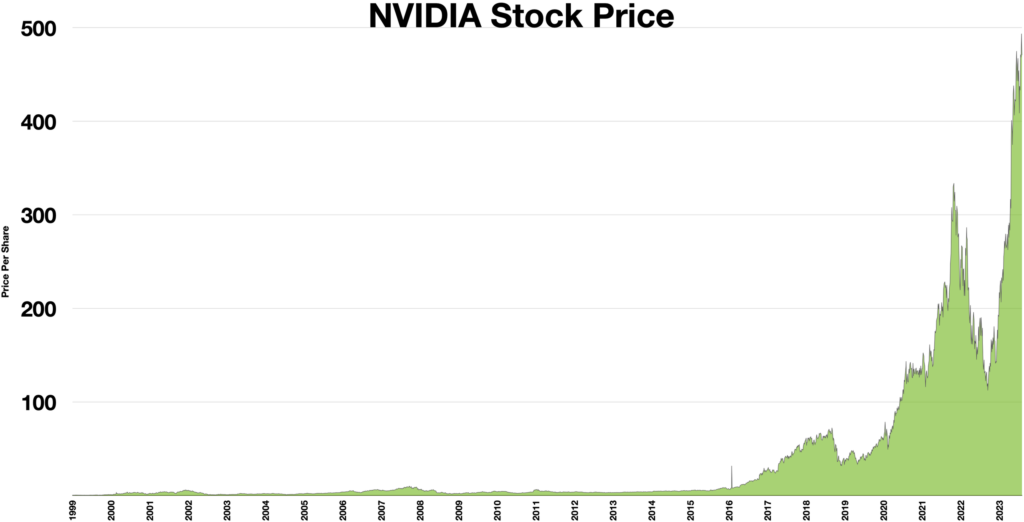

- $3.156 Trillion: Nvidia’s total market value as of the close on Wednesday, positioning it ahead of Microsoft ($3.076 trillion) and just behind Apple ($3.457 trillion) in the race for the title of the world’s most valuable company. A year ago, Nvidia’s market value was approximately $1.15 trillion.

- 154%: The gain in Nvidia’s stock price so far this year, as of the close of trading on Wednesday. Despite the impressive growth, shares dipped about 4% in after-hours trading following the release of the company’s earnings.

- 30%: The proportion of the S&P 500’s year-to-date gains through June that can be attributed solely to Nvidia.

- $26.3 Billion: Nvidia’s revenue from its data center business for the quarter ended July 31, reflecting a 154% increase from the previous year. Overall, the company’s revenue surged 122% year-over-year to reach $30 billion. By comparison, the expected revenue growth for companies in the S&P 500 is approximately 5% for the same quarter.

- $32.5 Billion: Nvidia’s projected overall revenue for the third quarter, with a margin of error of plus or minus 2%. This estimate ranges from $31.85 billion to $33.15 billion, slightly above Wall Street’s forecast of $31.7 billion. In the same quarter last year, Nvidia’s revenue was $18.1 billion.

- $121.1 Billion: Analysts’ estimate for Nvidia’s revenue for the fiscal year ending in January 2025. This figure would represent a doubling of the company’s revenue for fiscal 2024 and more than quadruple its earnings from the previous year.

Nvidia’s remarkable performance underscores its dominant position in the AI sector and its growing influence on the broader market. As the company continues to push boundaries, all eyes are on how it will navigate the challenges and opportunities ahead.