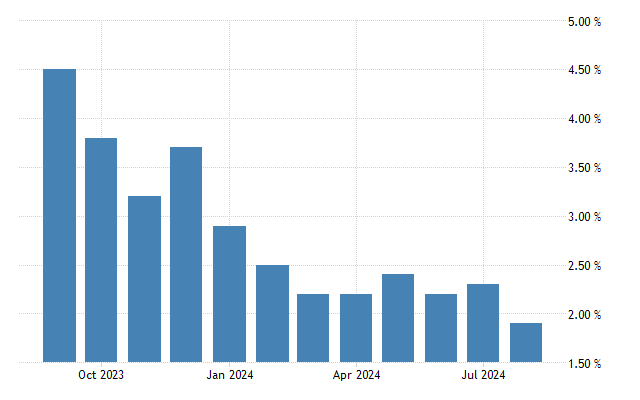

Germany’s inflation rate plummeted to 1.9% in August 2024, the lowest level since March 2021, fueling expectations of imminent interest rate cuts by the European Central Bank (ECB). The drop in inflation sent the euro and Bund yields lower, while Germany’s DAX index soared to record highs.

The sharp decline in inflation in Europe’s largest economy has alleviated fears of rising prices, increasing the likelihood that the ECB may soon cut interest rates. According to preliminary data from the Federal Statistical Office, Germany’s annual inflation rate fell to 1.9% in August, down from 2.3% in July, and below economists’ expectations of 2.1%.

This marks the smallest annual increase in Germany’s consumer price index since March 2021. On a monthly basis, the index declined by 0.1%, the first such drop since November 2023.

Energy Prices and Core Inflation Decline

The decrease in inflation was largely driven by a 5.1% annual contraction in energy prices, while inflation for goods dropped from 0.9% to 0%. However, services inflation remained unchanged at 3.9% for the fourth consecutive month.

Core inflation, which excludes volatile items like energy and food, eased from 2.9% to 2.8% year-on-year, the lowest since February 2022. Meanwhile, the harmonized index of consumer prices (HICP), used to assess inflation across the eurozone, dropped from 2.6% year-on-year in July to 2% in August, falling short of the 2.3% forecast.

This represents the slowest annual price growth for harmonized goods and services in Germany since March 2021. On a monthly basis, the HICP fell by 0.2%, mirroring a similar decline in January 2024.

Spain Also Sees Inflation Drop

Earlier on Thursday, Spain reported an unexpected drop in headline inflation. The country’s inflation rate slowed to 2.2% in August, the lowest since June 2023, down from 2.8% in July and below expectations of 2.4%. Core CPI inflation in Spain also dipped slightly to 2.7% year-on-year.

Spain’s National Statistics Institute attributed the decline to falling fuel prices, with food and non-alcoholic beverages also contributing to the downward trend.

Market Reactions

The euro fell by 0.4% to just below $1.11 against the dollar, extending losses following the release of U.S. GDP data and in response to lower-than-expected German inflation figures. The 10-year Bund yield dropped by 2 basis points to 2.25%, while the yield on the 2-year Schatz fell by 5 basis points to 2.34%, reflecting growing market anticipation of an ECB rate cut.

Germany’s DAX index maintained its session gains, rising 0.7% after hitting fresh all-time highs earlier in the day. Top performers included Bayer, Sartorius, and Rheinmetall, which gained 2.4%, 2.2%, and 2.1%, respectively. Other European indices also followed the DAX’s upward momentum, with the Euro Stoxx 50 climbing 0.8%.