Christian Dior SE, one of the most iconic names in the fashion industry, continues to capture the attention of investors with its stellar performance on the stock market. As the parent company of the Dior brand, Dior SE holds a significant stake in LVMH Moët Hennessy Louis Vuitton, the world’s largest luxury conglomerate, which has been a major contributor to Dior’s market success. Here’s a look at Dior’s recent stock market performance and the factors driving its growth.

Strong Market Momentum in 2024

Dior’s stock has been on an impressive upward trajectory in 2024, reflecting both the strength of its brand and its strategic positioning within the luxury sector. As of August 2024, Dior’s shares have risen by approximately 18% year-to-date, outperforming many of its luxury peers and broader market indices. This surge is driven by a combination of robust financial results, increased consumer demand, and strategic initiatives that have strengthened its market position.

Record-Breaking Financial Performance

Dior’s recent financial results have been nothing short of remarkable. The company reported a 16% increase in revenue for the first half of 2024, reaching €30 billion, with strong growth across all its divisions. The fashion and leather goods segment, which includes the iconic Dior brand, saw a 19% increase in sales, driven by continued demand for high-end products and successful new collections.

The brand’s performance in key markets like China, the United States, and Europe has been particularly strong, with double-digit growth in these regions. Dior’s ability to maintain high levels of profitability, with an operating margin of over 25%, further underscores its financial strength and appeal to investors.

Strategic Growth and Brand Appeal

Dior’s growth is not only a result of its financial performance but also its strategic focus on expanding its brand reach and enhancing customer engagement. The brand has been particularly successful in leveraging digital platforms, with a strong presence in e-commerce and social media, which has helped it connect with a younger, global audience.

The launch of new product lines, such as the Dior Men collection and the continued success of its flagship Lady Dior handbags, have also contributed to its strong performance. Additionally, collaborations with celebrities and influencers, as well as high-profile runway shows, have kept Dior at the forefront of fashion and luxury, ensuring its relevance in a competitive market.

Impact of LVMH Ownership

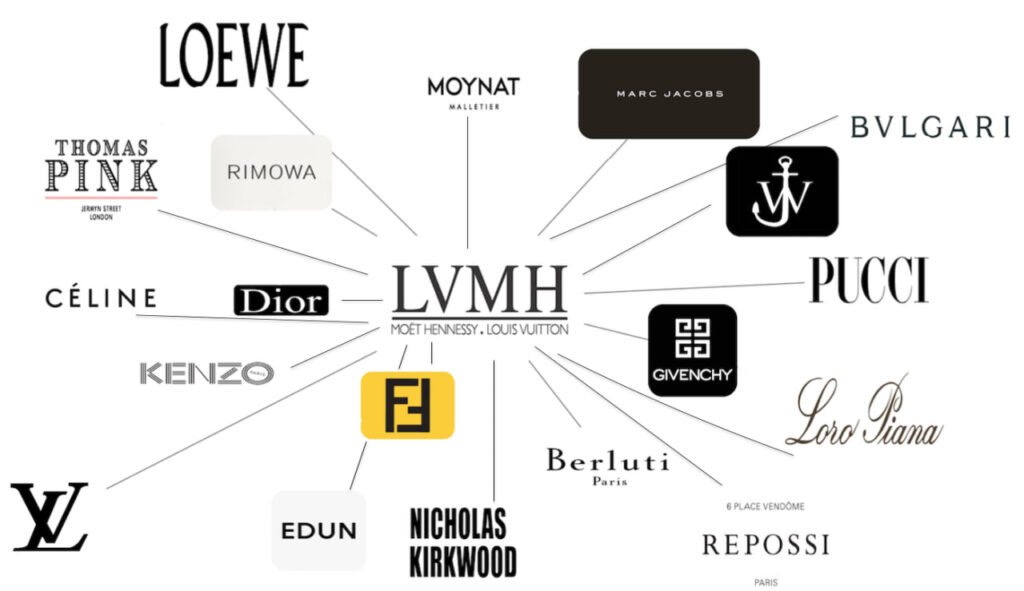

One of the key factors behind Dior’s stock market success is its close association with LVMH. Dior SE owns a 41% stake in LVMH, and this relationship has been mutually beneficial. LVMH’s strong performance, with double-digit revenue growth and significant market gains, has positively impacted Dior’s stock. As LVMH continues to thrive, Dior benefits directly from its financial success and strategic initiatives.

This symbiotic relationship also provides Dior with a level of stability and growth potential that is highly attractive to investors. The cross-shareholding structure between Dior and LVMH creates a powerful alignment of interests, ensuring that both companies continue to drive value for shareholders.

Outlook and Investor Sentiment

Investor sentiment towards Dior remains highly positive, with many analysts maintaining a “Buy” rating on the stock. The company’s consistent growth, strong brand equity, and strategic positioning within the luxury market make it a compelling investment choice.

Looking ahead, Dior is expected to continue benefiting from the global growth in luxury spending, particularly in emerging markets like China and India. The brand’s focus on innovation, sustainability, and digital transformation is likely to further enhance its market position and stock performance.

In conclusion, Dior’s performance on the stock market reflects its status as a luxury powerhouse with strong financials, strategic foresight, and an enduring brand appeal. For investors seeking exposure to the luxury sector, Dior represents a solid opportunity with the potential for continued growth and long-term value creation.