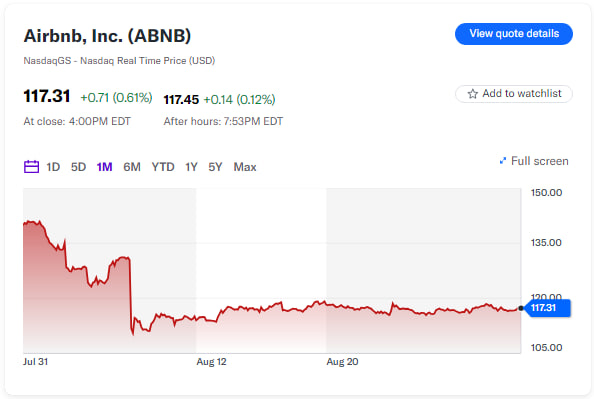

Airbnb (ABNB) has hit a rough patch, shedding 25% of its market value over the past six months, making it one of the worst-performing large-cap internet stocks in that period. Over the past year, Airbnb shares have dropped 10%, the only stock in the S&P 500 Hotels, Resorts, and Cruise Lines subgroup to be in the red.

Airbnb’s unique position at the crossroads of travel, online commerce, and the gig economy once fueled its rapid growth. The platform, which popularized the concept of renting out rooms or homes to travelers, now boasts over five million hosts and more than 1.5 billion cumulative guest arrivals. However, the company is now feeling the effects of broader economic trends impacting the travel, lodging, and entertainment sectors. As post-COVID travel spending slows, consumers are becoming more cautious with their spending.

Hilton’s CEO, Chris Nassetta, highlighted this trend, noting on a recent earnings call that consumers are borrowing more and spending less on travel. Airbnb’s CEO, Brian Chesky, echoed similar concerns, citing shorter booking lead times and signs of slowing demand from U.S. guests.

Despite these challenges, Airbnb’s growth prospects remain strong compared to its competitors. Wall Street projects the company’s gross bookings to grow nearly 11% this year, outpacing the 4%-to-6% growth expected for rivals Expedia and Booking.com. Analysts also anticipate double-digit revenue growth for Airbnb over the next four years, compared to the 5%-to-8% growth projected for Marriott and Hilton.

However, Airbnb’s stock has been punished more severely than those of its peers, partly due to its relative newness and lack of long-term operating history. Since going public in late 2020, Airbnb has experienced extreme fluctuations in the travel market, with gross bookings soaring by an average of 82% per quarter over the next two years. This volatility has left investors relying heavily on short-term data, leading to uncertainty about the company’s long-term growth potential.

Only about a quarter of analysts currently rate Airbnb as a “buy,” but some, like Bernstein Research’s Richard Clarke, see potential for continued growth. Clarke notes that Airbnb is well-positioned to benefit from lodging demand outpacing hotel supply.

Airbnb’s current scale also leaves room for significant expansion. Chesky pointed out that for every nine hotel rooms booked, only one Airbnb is booked, suggesting a vast untapped market. If Airbnb can capture even a fraction of these hotel guests, the company could double its current annual bookings.

Airbnb is also planning to diversify its offerings, with new services expected to be introduced later this year. Chesky hinted at a “winter release” in October, which will include host-provided services and other developments. These additions could eventually diversify Airbnb beyond its core product.

While it will take time for these new services to significantly impact revenue, Airbnb is currently trading at a near-record low valuation, offering a potential opportunity for investors. With a discount of over 20% compared to gig-economy peers like Uber and DoorDash, Airbnb might be worth a closer look for those willing to ride out the current market turbulence.